We may earn money or products from the companies mentioned in this post. As an Amazon Associate, I earn from qualifying purchases.

Sometimes I look at Abby and Jake and have to pinch myself! Do I really have a 10 and 12-year-old? I feel like they were just toddlers who let me put adorable outfits on them. A lot has changed since then, right? What hasn’t changed is that something is always changing. As parents, we meet the next big challenge head-on and today I want to chat about giving them a little more freedom and how Greenlight, a kids debit card, helps us do just that!

First, let me set the scene…

Abby and Jake run into the house excited that a neighbor friend invited them to the trampoline park. Yay, right? Then the hunt for cash ensues and before I know it (if I even have cash on me) I am handing them four $20s and I know that I am never seeing that change. They run out excited and happy but then I think to myself, yikes, “shouldn’t they have paid for that” or how will they ever know that “money doesn’t grow on trees”. Or in my kitchen for that matter.

[Enter] Greenlight card.

Now when the same scene ensues, they have to make sure they budgeted enough money in their Greenlight account for this surprise outing or, if I am feeling generous (and cashless), I can instantly transfer money into their accounts to cover the exact cost of admission.

So, today I want to share all about our personal experience with the Greenlight card! We signed up on our own back in May and got both kids their own card. I have become such a fan of Greenlight, that we recently partnered with them to help spread the word. So, let’s start from the beginning with a little bit about how the card works, the cost, and then some feedback from the kids about what they like the most about having their own debit card.

The Greenlight Card

The Greenlight card is a kid’s debit card. But, it’s also much more. Between the card and the Greenlight app, it gives parents a wonderful opportunity to teach their kids smart money habits. Actual hands-on experience like this fills a major gap between the education they receive at school and real-world life skills. With the Greenlight debit card kids are able to receive their allowance, earn money by doing chores, manage savings and set savings goals, and even invest. Kids love the freedom that comes with having their “own credit card” and parents love being able to instantly send money to their kids, monitor their spending via flexible controls, and get real-time notifications every time their kids spend money.

How does Greenlight Card Work?

The card basically works more like a prepaid debit card vs a traditional credit or debit card. Your child has a physical Mastercard debit card (that you can even personalize) that they can use anywhere credit or debit cards are accepted, including online. The parent has an app in which they can use their bank account or debit card to fund their Parent Account. This is basically a holding place for money that you can transfer in and out of the kid’s accounts. Parents can manage multiple kids’ accounts from their app and the kids have their own app where they can manage their individual accounts. It’s very user-friendly!

I will go into more detail about all of the features here in a bit but want to answer a few big questions first!

Does Greenlight run a credit check when setting up a new account?

This was my number one question and not knowing the answer is what kept us from getting Greenlight kids debit cards for so long. I wish I would have looked into it sooner because the answer is NO. No credit check is run when opening up Greenlight card accounts for your kids.

Our credit is great but as you know, in starting our Airbnb business, we have financed a few condos down on 30A over the past two years. It is very hard to get loans for non-warrantable condos and often having excess credit checks and opening new accounts can hurt you when it comes to underwriting.

Anyway, so it’s basically as I mentioned above, not much different than buying a prepaid Visa card at the store. However, the Greenlight card and app offer SO MUCH MORE when it comes to actually teaching kids about money and monitoring / managing kids spending as they spread their little wings. And it’s very much worth the small monthly fee.

How much does a Greenlight card cost?

The basic Greenlight program cost is only $4.99 a month. This includes up to 5 cards, access to the app, parental controls and covers everything you need to benefit from the Greenlight kids debit card.

They also have the Greenlight Invest plan for $7.98 a month. This is what we signed up for because we really wanted the kids to have access to the stock market and this has been one of their favorite features!

There is also a Greenlight Max plan for $9.98 a month which provides a lot more. I am wondering if is new because I feel like I would have signed up for this one given the option. The Greenlight Max plan provides all of the above but also identity theft protection, purchase protection, 1% cashback on all purchases, and even cell phone protection. Being covered in the case of lost or stolen cards is key here. You can also get the black matte card with this account if they want to be flexin’. Haha.

Ok, as I am writing this, I just went in and switched to the Greenlight Max plan. Well worth the extra $2 for that added protection especially when I am letting them use them online and keep them in their own wallets.

Please note that the cards included with the plans are just basic cards. The personalized cards are available for $9.99 each. Abby put a photo from her 6th-grade graduation on hers and Jake didn’t like any of the photos I suggested, so he went out front and took about a thousand selfies with my phone until he had the perfect one. So now whenever I see it it just makes me smile from ear to ear!

Why not just get a regular card from your bank?

Right, because it’s free. While this is very much a valid option, with Greenlight you are really paying for the app features. A regular debit card is great for an older kid but since Abby and Jake are only 10 and 12, I like being able to monitor their accounts and we really enjoy watching them manage their own money within their Greenlight account.

Features of the Greenlight Kids Debit Card

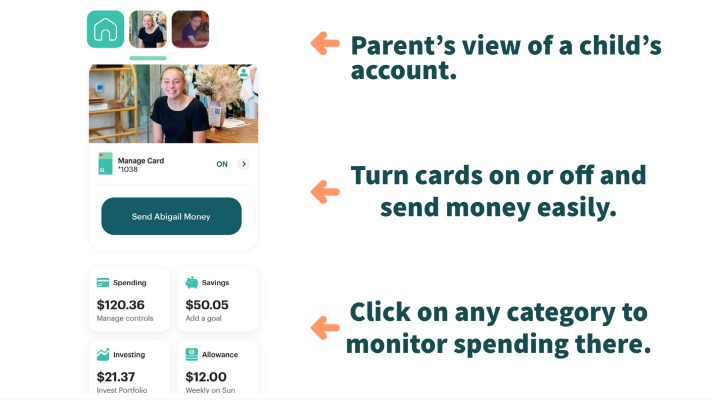

So, let’s talk about all of the features that are available to you for that $5, $8, or $10 a month. And I want to mention that within the parent app you can turn the cards OFF or ON at any time. We have never had to turn ours off but this could come in handy both when it’s misplaced or when some tough love is needed.

The Greenlight App

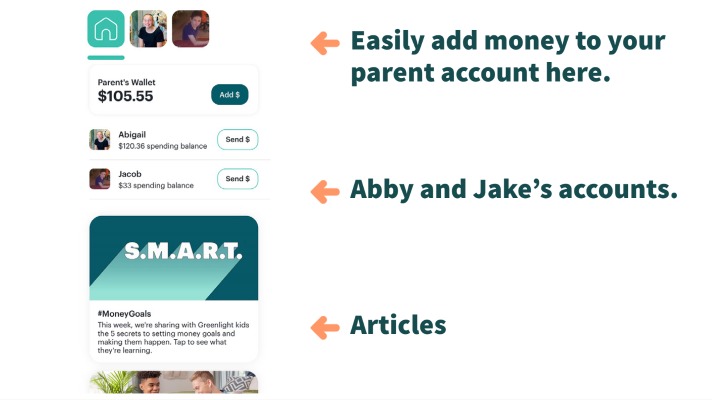

Your Greenlight account is managed via the Greenlight App. The parent’s account and the children’s accounts look similar but are different. When I visit my app, I am met with my Parent’s Wallet balance and then each of the kid’s debit card accounts. There are also articles sharing what the kids can learn about this week. I told you it’s cool! Here is a look at what my account looks like.

Within the app, you can click on each of your kids and that is where most of the magic happens. It’s here that you can send them money, take money away, review spending, giving, set up additional controls, and more. Here is a little more about all of the features available with your Greenlight debit card for kids.

Real-Time Spending Notifications

You obviously don’t have to have these notifications on but they are nice! I actually get a push notification every time that their card is swiped. It’s reassuring! When the kids flew to St Louis by themselves this summer, it was their Gabb Wireless phone and Greenlight card that made it so much easier. After my mother-in-law sent them through security for their return flight home, I could see Abby sitting at Auntie Anne’s, and then minutes later I got an alert that she bought herself (and her brother) breakfast. I know, it’s a little “stalkerish” but that gave me SO MUCH peace of mind on that adventure.

Instantly Transfer Money

This is my favorite feature because we NEVER have cash on hand. It’s basically the scenario from the beginning of this post. And when I do, I almost never see my change again. As Abby and Jake are getting older, they are often asked to go places with friends, even on weekend trips down to the beach. Greenlight is so helpful when it comes to either funding these outings or helping them budget and save for special events.

Typically if a friend invites them somewhere we will cover it about half of the time. For example, I will pay for them to go to the trampoline park with a friend, but when another friend asks them the very next day, they have to pay for it themselves. Regardless, they take their Greenlight card with them and pay for admission and any snacks. I reimburse them for what we agreed on out of my parent account either before or after the outing.

The instant transfer has come in super handy a couple of times. Once, Abby went to get her nails done with a friend and her card was declined. Turns out she had moved a bunch of money into savings and didn’t have enough to cover it in her spend anywhere account. I got a real-time alert that it was declined just as she was calling me and was able to instantly loan for $30, which she transferred back to my parent account later that evening when she sat down to rebalance her account. To be honest, it was a GREAT learning lesson and now she always knows her available balance.

Using Your Greenlight Card at an ATM

And when they need cash, they can always use their card at any ATM. Yes, even a Cupcake ATM. But when you don’t want them to be able to take out cash, you can turn this feature off.

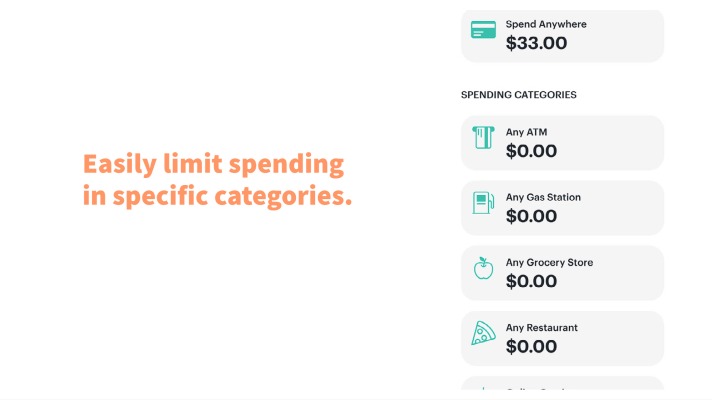

Category or Store Specific Restrictions

Within the app, parents have fun control over where and what the kids can spend money on. We don’t really use too much but have restricted the online gaming category because give a 10-year-old a debit card and he will probably want to buy all of the Robux. Am I right?

I do like this for when they get older because I can see it coming in handy when they start driving. Being able to designate $100 a month to “gas” or even $50 to “restaurants” on an overnight getaway with friends. You can also limit what they can take out of the ATM. It really is such a useful feature when kids need a little extra help initially learning how to manage their money.

Setting up allowance

We love this feature! Our kids get an allowance each week that actually is not tied to chores. I really enjoy Amy McCready’s book The Me, Me, Me Epidemic: A Step by Step Guide to Raising Capable, Grateful Kids in an Over-Entitled World and her principles include giving them a set allowance and teaching them to manage their money versus paying them for taking care of their own daily responsibilities. I actually think this book ties in really well with the use of our Greenlight Cards. We do pay for extra projects when they want to earn extra money or we need something done. This includes cleaning the car, weeding the yard, deep cleaning the refrigerator type work.

So, with their allowance, we pay $1 / their age. Abby currently gets $12 a week and Jake gets $10 a week. This translates to $40/$50 a month which is a good little “paycheck” from which they can learn to manage their money and use it for more everyday expenses – like when they want a toy or to go to the trampoline park – AGAIN. They have to make real decisions about how they are spending it. And while this is NOT tied to their responsibilities around the house, it is tied to their attitudes, behavior, and grades. If any of those are lacking and a warning doesn’t work, they will forfeit their allowance that week.

A couple of years ago when I first read Amy’s book, we tried to do this but after several weeks we would run out of cash, and then we were always “owing” them their allowance and ended up not being as helpful as it should have been. Since setting our cards up for auto allowance, we have been able to hold up our end of the bargain and in turn, they have done the same, just as the book and principles intended.

If this sounds at all interesting to you, I highly recommend that you read The Me, Me, Me Epidemic. It offers some great insight for raising compassionate and capable kids and is the closest we have to a “parenting style”.

Using Greenlight to manage kids chores

Above I shared our family’s approach when it comes to chores and money but that doesn’t mean it’s the only way to do it. I know a lot of parents who tie chores to rewards and it works great for them. So, whether you are using the chores feature for special projects like we do or to manage all of their day-to-day responsibilities, it’s a great tool to have at your disposal.

In the Chores section of the app, you can assign each kid weekly or one-time chores, manage the frequency it needs to be done, and which category the payments go to (savings, spending, giving). It’s a pretty cool setup where you can make a custom Weekly Chore list, breaking things down by day and adding extra descriptions so that there is zero confusion on what needs to be done and when.

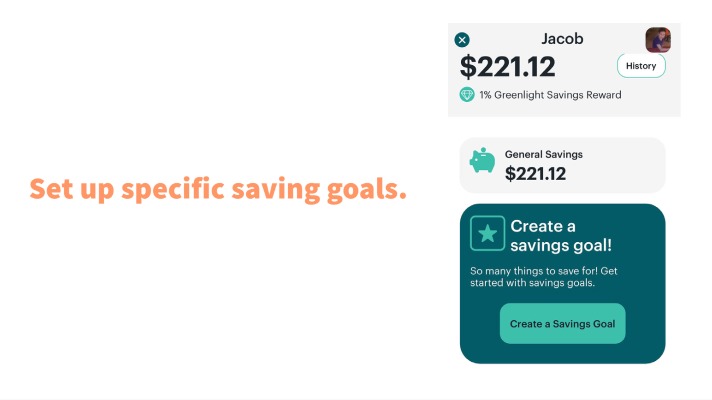

Savings, Interest & Rewards

The kids love seeing their savings grow within their Greenlight app. It’s funny because while Abby gets more allowance, Jake has much more money stashed away. Kids can move money into their Savings account within the app. There they can set a specific goal for a specific item or just watch it grow. When money is in this Savings section it is NOT available to spend (like Abby learned at that nail salon). So kids do have to be smart and intentional about how much they are allowing themselves to spend and how much they want to save as well as what constitutes a good reason to move money between the two. Sounds like real life doesn’t it!?!

With the Greenlight Max account, I just upgraded to the kids get 2% back of their average daily savings balance added back into their account, rewarding them for their smart money management. With the regular and invest account, they still receive 1% back.

There is even the option for parent-paid interest where you set the % that you want to contribute to their savings account. The kids can even activate a round-up feature where each purchase is rounded up and the difference is deposited into their savings.

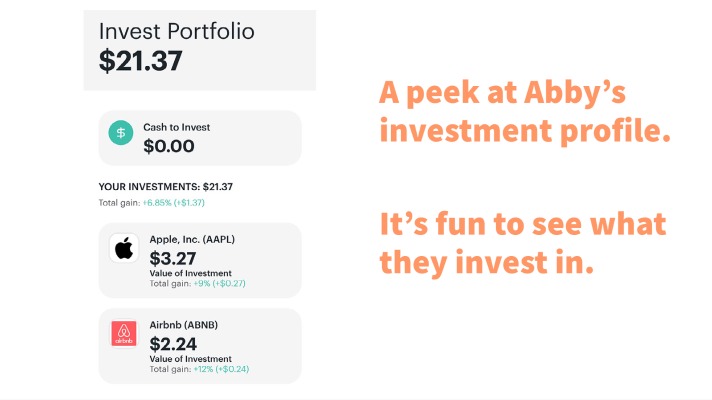

Investing with Greenlight App

This is probably the kid’s favorite feature, and Matt’s too! You are probably wondering how kids can be investing in the stock market. When you initially set it up it actually is tied to the parent that manages the app and the cards. So, technically under my name. I have to approve the trading requests as the kids initiate them. The kids (Jake especially) love to research stocks and they are very interested in watching their stocks perform in the markets. The learning experience they get from this is incredible. Jake can carry on a full conversation about particular stocks with us and even make the decision to buy a bond fund. They can invest in small amounts, buying fractional shares, and monitor their individual profiles from the Greenlight app.

Abby and Jake share why they love their Greenlight kids debit cards

I asked the kids to share with you what they like about their Greenlight cards and here are their responses. Totally unedited. I am proud of what a good little writer Abby is and Jake with that stock market! LOL

Abby: I enjoy owning a Greenlight Card because I feel that I have the freedom to spend my money on whatever I’d like. I also love my Greenlight card because I can invest my own money in a variety of different stocks and watch them daily. To me, Greenlight Cards are a great alternative to cash because I sometimes lose cash.

Jake: I like that you can transfer money between savings, spend anywhere, and more. You can also do investing and buy stocks and hope that the market doesn’t crash. I also like that you can send special chores to your children and they can get extra money as a reward. This is why I like Greenlight.

Get A Greenlight Kids Debit Card

Thanks for reading and letting me share why we love the Greenlight cards so much! If you would like to learn more or are considering getting Greenlight cards for your kids feel free to visit their website for more information.

Click here to learn more about Greenlight!

And if you have any questions of if YOU love this company as much as I do, make sure to leave me a comment here on my blog or shoot me a message on social media.

FOLLOW

OurLittleLifestyle on Instagram

OurLittleLifestyle on Facebook

Does your child have a Greenlight Card? Leave me a comment and let me know!