We may earn money or products from the companies mentioned in this post. As an Amazon Associate, I earn from qualifying purchases.

If you have been following us for a while, you know that we have leveled up our family travel over the past five or six years. In fact, we have visited over a dozen new countries in the last 36 months! So, how do I do it? I can confidently say that travel hacking and using credit card miles and points have changed our lives!

I got into this hobby about five years ago and have become quite the expert! Everyone wants to know how we do it and how we can travel so often and for so cheap.

For years, I have held off on a robust explanation because, to be honest, it’s fairly complicated. There is a lot to explain in order for it to make sense truly. But today, I am proud to share my detailed Miles and Points Guide to help you get started.

The same strategies apply whether I am looking to fly in business class for a fraction of the price or get my family across the pond in economy several times each year. I actually don’t even love the phrase “travel hacking” because it’s not a hack but rather a strategy that you can leverage to make the most of your day-to-day spending. But it is life-changing. So, let’s dig in!

Ultimate Guide To Using Credit Card Miles And Points To Travel Cheap

Whether you’re a beginner or an experienced traveler, my travel hacking guide will show you how to maximize your miles and points for flights, hotels, and more. I will go through topics in a specific order, starting with a broad overview and then getting into more specifics. It is important that you read this from top to bottom and then read it again! I will point out key terms by underlining them.

Don’t feel discouraged if you feel overwhelmed at first. It has taken me years to perfect this craft, and I still learn something new every single day. Plus, the world of credit card miles and points is always changing. So, you have to be ready to pivot and adapt at any time.

But one thing remains the same… this strategy ONLY works if you pay off your credit cards every month. You never want to incur interest charges. The key to travel hacking is never carrying a credit card balance. If you have issues managing credit, I honestly hope you stop here.

Travel Hacking: Intro To Miles and Points Travel

Before diving in, it’s important to understand the basics and review some frequently used phrases in the miles and points world. Throughout this post, I will underline key phrases or concepts that you need to be familiar with. We will start with a very broad overview. So, let’s go!

Understanding Transferable Points vs Fixed Points

It’s very important to understand that there are two main types of points:

- fixed loyalty points

- transferable credit card points

Fixed Points: Fixed points and miles are tied to airline or hotel loyalty programs. These would be your Delta SkyMiles, Hilton Honors points, etc. They are stuck in that program and can, for the most part, only be redeemed for bookings on that specific airline or hotel’s website. These are generally seen as less valuable for that reason.

Transferable Points: These miles and points are typically tied to credit card programs and can often be transferred to airline or hotel loyalty programs. These points are usually earned through having some type of premium credit card, and examples include Chase Ultimate Rewards, Amex Membership Rewards, Capital One Rewards Miles, and Citi ThankYou Points.

The magic lies in the transferable points. You can transfer them to many hotel and airline loyalty programs to maximize their redemption value. When strategically transferring them, I often get 5 cents or more per point. Read that again. This is the key takeaway from this post!

COMMON MISTAKE: You will get the least possible value for points when redeeming them through a bank’s own rewards program, whether it be for travel or gift cards/cash back. It’s often 1 cent per point, and you are selling yourself way short!

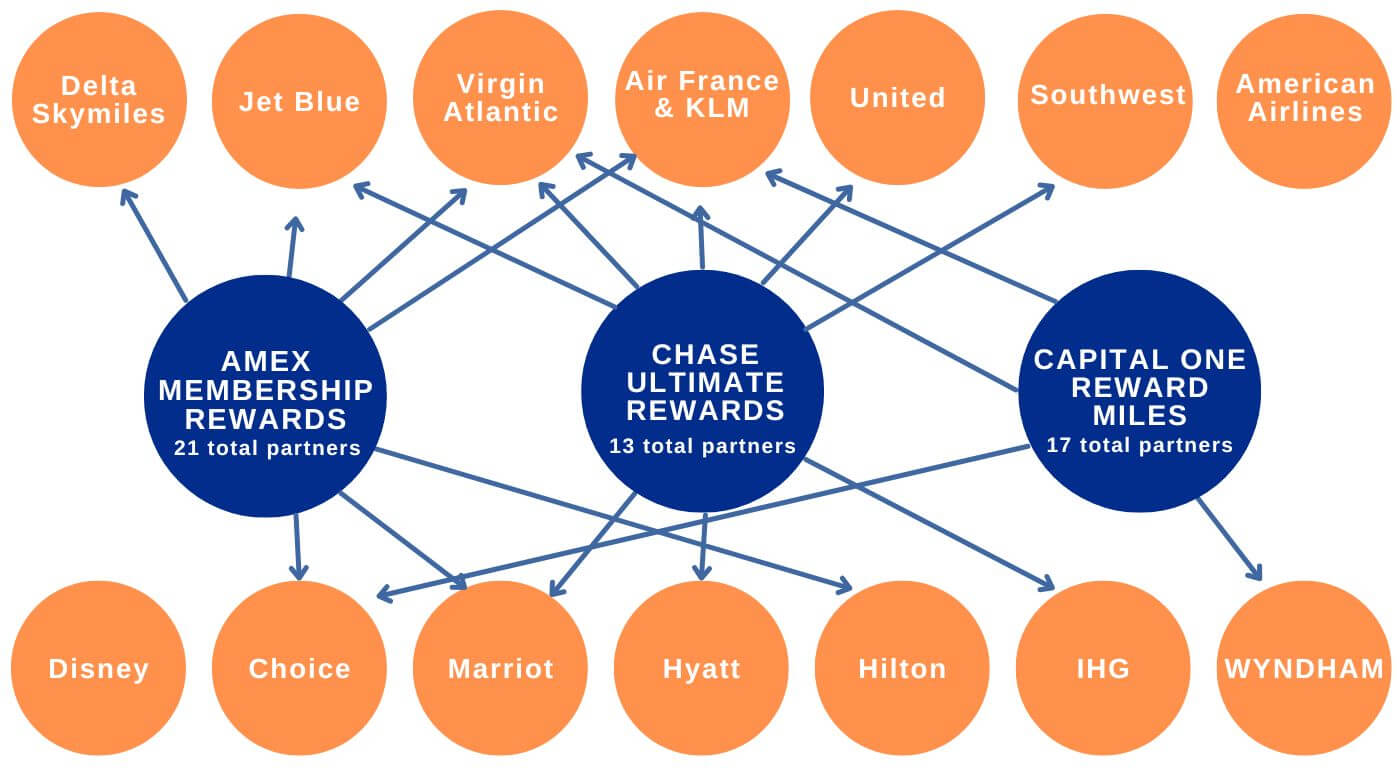

Below is a sample graphic that I made to show just some of the popular transfer partners. There are so many more, so please don’t take this as a complete list. I just want to show you how the fixed points can’t leave their orange circles. But, the transferable points can leave their blue circles.

LINKS: Amex Transfer Partners | Chase Transfer Partners | Capital One Transfer Partners

American Express has over 20 transfer partners, Chase has 13, and Capital One has 17 transfer partners. As you can see, Chase is the only one that transfers to Hyatt and Southwest, and none of the popular banks transfer to American Airlines. However, this doesn’t take into consideration airline alliances, which I will discuss later.

Note: that this chart was accuracte as of early 2025, but these can change, so please make sure to check the partner links above.

These are three key pieces to maximizing miles and points for travel:

Loyalty Programs: Reward systems offered by airlines, hotels, or credit card companies. These include your American Airlines miles, Marriott Bonvoy points, etc.

Transferable Points: Points that can be transferred to multiple travel partners. Examples include Chase Ultimate Rewards and Amex Membership Rewards, etc.

Redemption Value: The monetary value of your miles and points when redeemed. This is essentially cash price divided by the number of points needed to give you a redemption value in points.

Understanding these fundamentals helps you make smarter choices about earning and spending rewards. So, let’s expand on this because I often get asked, “What is the best travel credit card?” But there is more to unpack before I can answer that question. But I do, later in this post!

Types Of Travel Credit Cards

The right credit card can make or break your travel hacking rewards strategy. Just as we discussed the two types of miles and points (fixed and transferable), we have two types of credit cards to discuss:

- Co-branded Cards

- General Rewards Cards

A bank will issue both types of credit cards. The most common banks are Chase, American Express, and Capital One. Other issuers include Citi, US Bank, Barclays, and more. It is essential that you know what type of card you are getting and what kind of rewards it earns. Many of these will have an annual fee ranging from $49 to $895, which we will discuss later.

Co-Branded Credit Cards: Branded credit cards tied to specific airlines or hotels. These earn loyalty points and frequent flyer miles only for that rewards program and are generally fixed points. These include your Delta SkyMiles American Express, Marriott Bonvoy Boundless, American Express Hilton Honors Card, American Airlines, Chase United Plus Explorer Card, etc.

Sometimes you can get great signup bonuses from co-branded cards! For example, right now the Marriott Bonvoy Boundless Card is offering 5 free nights (up to 50k each) as a sign-up bonus! This is a great deal for a $95 annual fee card.

General Rewards Credit Cards: These credit cards offer flexible points that can be redeemed through their rewards portal or transferred to hotel and airline loyalty programs. Examples include the Chase Sapphire Preferred and Reserve, American Express Platinum card, and Capital One Venture X. There are more, but I am going to concentrate on these three in this post and have links and pros/cons of each later in this post.

Do you see how your American Express Delta Skymiles Platinum Card is NOT the same as the American Express Platinum Card? They sound the same, but are completely different cards.

For the most part, general rewards credit cards and transferable points will give you the highest redemption value. But before we talk about redeeming points, let’s discuss the central concept of travel hacking, which is how to earn miles and points!

How To Earn Credit Card Miles and Points

Travel hacking enthusiasts earn miles and points mainly through generous credit card sign-up bonuses. You can also earn points through your regular credit card spending, travel, and even shopping portals!

Credit Card Sign-Up Bonuses (SUBs): This is a one-time offer you get when signing up for a credit card. These are often tied to a minimum spending requirement. For example, spend $4000 in the first 3 months and earn 75,000 points. Both types of credit cards offer sign-up bonuses. So, know whether you are earning fixed or transferable credit card rewards.

Credit Card Earning Rates: Different cards earn differently. The base is 1 point per dollar spent. However, some cards, like the Capital One Venture X, offer 2 points on all purchases. Others offer elevated earning rates for different categories, such as the Chase Sapphire Preferred, which earns 3x on dining. Many people work hard to maximize earnings and put specific purchases on specific cards.

You can also earn points from your travels. Always make sure to have your hotel or airline loyalty program number on your reservation to ensure you earn points for your hotel stays and flights. This also helps you earn status with different loyalty programs!

Another way is through shopping portals. Most airlines, including Southwest and American Airlines, have shopping portals that offer loyalty points and miles simply for clicking through their website or extension. Many banks also have some kind of portal that often offers additional rewards. Additionally, you can take advantage of merchant offers on a credit card to get statement credits as well.

Travel Credit Card Annual Fees & Perks

It’s important to understand that the most popular rewards-earning credit cards have annual fees. The good news is that these are often offset by lounge memberships, annual credits, companion passes, travel credits, and other valuable perks, including TSA PreCheck and Clear memberships. You just have to stay on top of these perks to maximize their value. I would guess that over half of credit card holders leave a good bulk of their credits unused each year.

Example #1: Capital One Venture X

I want to use the Capital One Venture X as an example because I think it is a great travel credit card for beginners. This card’s annual fee is $395, which may seem steep. That said, you receive a $300 Capital One Travel credit each year and 10,000 bonus points on your card anniversary. These two essentially negate the annual fee. Additionally, you get a $120 credit toward TSA or Global Entry, access to Capital One Lounges, and a Priority Pass Lounge Membership for yourself.

You may enjoy reading How To Get Into Airport Lounges

Example #2: American Express Platinum Card

Another very popular card is the American Express Platinum Card. With a steep $895 annual fee increase starting late 2025, you may be apprehensive. However, I get that back and so much more with the free monthly Walmart+ Membership, $200 annual Uber credits + $120 Uber One credit, $200 annual airline incidental credit, $600 Amex hotel credit, $199 Clear credit, $300 annual digital entertainment credit, $400 Resy dining credit, $300 Lululemon credit, $209 Clear+ credit, $100 annual Saks Fifth Ave credit, access to Amex global lounge collection and more.

Yes, it’s like a giant coupon book, but that’s almost $1500 in value right there. Plus, this card earns 5X on all airfare purchases, so I always use it when I book flights.

Another valuable perk is that many premium cards also come with pretty robust travel insurance and purchase protection for purchases made on that specific credit card. For example, the American Express Platinum card comes with trip cancellation and interruption insurance of up to $10,000 per trip and baggage insurance of $2000 for a checked bag when you use it to purchase travel.

I am not going to dive deep into these types of perks in this post, but just be aware of them. As I expand this section of my website, I will be adding more posts including more details about popular credit cards. You will be able to view all of my Miles & Points posts here.

How To Redeem Your Miles and Points For Maximum Value

The key to travel hacking is redeeming your points wisely. And, to be honest, this is where the hard work and attention to detail come in. I find it easy to earn points, having earned millions over the past few years. However, I am much more strategic when spending them because I love to get the most value for my miles and points. I always use points to fly my family to Europe!

MISTAKE: Fixed points are what they are and can only be redeemed through their specific loyalty program. But if you are redeeming your transferable credit card points at 1 cent each for cash back, gift cards, or travel through the bank portal, you are making a huge mistake. This section will blow your mind!

Redeeming Transferable Credit Card Points

By now, you should understand transferable points, which should be your biggest takeaway from this travel hacking guide. Remember that programs like Chase Ultimate Rewards, Capital One Rewards, and Amex Membership Rewards let you transfer points to airlines or hotels for better value.

You just need to make sure your specific card has these types of points – because not all do! Some that do are the Chase Sapphire Preferred and Reserve cards, American Express Gold and Platinum Cards, and the Capital One Venture X.

SIDENOTE: There are regular personal cards, which this post is primarily about, and also business cards. If you have a business, even a very small one, business cards provide a great opportunity for additional credit card accounts and earning. I will touch on that at the end of this post.

Once you transfer a number of your points to the loyalty program of your choice, they become fixed points for that brand. The key is to transfer only when you are ready to book. Also, you can only transfer to your loyalty account, and the names must match. But you can book flights for your family through most airlines. So, in most cases, I transfer points to my airline loyalty account and then book for all four of us.

The following sections apply to loyalty points and programs in general. You just need to make sure you sign up for a free loyalty account with the airline or hotel prior to transferring, and sometimes, there is a little delay before you can do so.

Understanding Loyalty Reward Charts

All hotel and airline loyalty programs are not the same! Some use a fixed rewards chart, while others use dynamic award pricing. What is the difference?

Fixed Award Chart: This means that award travel rates are pre-set on a specific chart. For example, Hyatt hotels have a fixed award chart that you can view here. Some airlines, offer a fixed award chart based on distance. Generally, fixed award charts are a sweet spot because the required points stay the same regardless of high demands and increasing case prices.

For example, I was able to book two nights at the Hyatt Centric French Quarter New Orleans for the Eras Tour in October at 18,000 points each. The cash rate was $800 per night that weekend. So, 36,000 points saved me $1600, making my point redemption value 4.5 cents each.

Dynamic Award Pricing: This means the number of miles and points required to book a flight or hotel stay varies. This can be good or bad. In some cases, Delta could want 150,000 miles for a flight that costs $750, which would be a terrible points redemption value at half a cent per point.

On the other hand, I just booked a round-trip business class flight from Atlanta to London via Virgin Atlantic, which also uses dynamic pricing for only 34,800 American Express Membership Rewards points plus $850 in taxes using a saver award, plus a transfer bonus that we will talk about later. The cash price would have been $6200. My points saved me $5350 and let me fly Virgin Atlantic Upper Class! It sure beats redeeming those points for $348 through the portal at one cent each. My points redemption value was a whopping 15 cents per point. But this deal meant I had to fly out on January 28th and return home on February 4th. Sign me up!

TIP: To calculate your points redemption value, use the following calculation: (Cash Price – Taxes Paid) / Points = Cents Per Point

Is this starting to make sense? These are just two examples, but if you look at the Points story highlight over on @ourlittlelifestyleblog on Instagram, you can see more real-life redemptions our family has done!

However, award availability is not always guaranteed for both airfare seats and hotel nights. Most hotels and airline loyalty programs have a set number of awards available on any given night or flight. So, how do you find them?

Hotel Sweet Spots For Point Redemptions

First, log in to that hotel’s app or website under your loyalty account. Run a search for your days. Many have a toggle or a checkbox for searching with points, so make sure to select that.

Then, check to see if there are any points or award nights available. If there are, you can either use the fixed points you already have in that loyalty rewards program or transfer in some transferable points in order to book.

Not all cards transfer to all hotels and airlines. For example, Chase Ultimate Rewards are the only popular reward points that transfer to Hyatt, which is what makes them so valuable due to their fixed award chart. We have transferred Chase Ultimate Rewards to Hyatt and stayed at amazing Hyatt properties all over the world, such as the Hyatt Regency Coconut Point and the Hyatt Centric Murano Venice.

LINKS: Amex Transfer Partners | Chase Transfer Partners | Capital One Transfer Partners

Some hotel loyalty programs offer extra rewards to their loyalty members and credit card holders. For example, if you have an IHG Rewards Credit Card, you get the 4th night free on award stays. This essentially saves you an extra 25%. Likewise, Hilton Honors members with silver, diamond, or gold status can get their 5th night free when booking a standard room reward stay of 5+ nights.

Booking Airfare With Miles And Points

Booking flights works the same way as booking hotel award nights! However, there is one very important addition: airline alliances. What are airline alliances?

Understanding Airline Alliances

Airline Alliances: These are groups of airlines that partner together to expand their reach and often allow you to book through each other’s platforms. This means using one airline’s loyalty program to book flights on a partner airline. Here are the three main alliances and the biggest airlines in them. This is just a small sample of each alliance, as there are a lot of additional international partners.

Sky Team: Delta Air Lines, Air France, KLM Airlines, ITA Airways, Korean Air, China Airlines, Virgin Atlantic, and more

Star Alliance: United Airlines, Air Canada, Singapore Airlines, Turkish Airlines, ANA. Lufthansa. Air New Zealand, TAP Air Portugal, Copa Airlines, and more

Oneworld: American Airlines, British Airways, Qatar Airways, Qantas, Cathay Pacific, Japan Airlines, Iberia, Finnair, Alaska Airlines, and more

I listed the US-based carrier first because it’s important to know whether or not you are in a hub for that airline. For example, I fly out of Atlanta for most international trips. It’s a Delta hub, so I primarily fly the Sky Team carriers. These are some of the main hubs for the popular airlines. Of course, other carriers serve them, but a good number of the flights will be on their partner airlines.

Delta Air Lines: Atlanta (ATL), Detroit (DTW), Minneapolis (MSP), New York (JFK, LGA)

United Airlines: Chicago O’Hare (ORD), Denver (DEN), Newark (EWR), Houston (IAH), San Francisco (SFO), Washington Dulles (IAD)

American Airlines: Dallas/Fort Worth (DFW), Charlotte (CLT), Chicago O’Hare (ORD), Miami (MIA), Philadelphia (PHL), Phoenix (PHX)

Booking Airline Award Flights

Understanding airline alliances is a key part of travel hacking because, in many cases, the best redemption value will be to book flights with airline alliance partners. I want to note that partner airlines often sell the same flight. It’s literally the same plane. They only require different mileage and point totals across different airline loyalty programs. Fortunately, all three major banks transfer to SkyTeam partners Virgin Atlantic and Flying Blue, which I use most when flying in and out of Atlanta.

QUICK NOTE: You will need to pay taxes on flights booked with points, and these vary significantly by route and carrier. So, factor that into your points redemption value and run multiple searches!

Points Redemption Flight Example

For example, I just booked our flights to Europe for our annual summer trip. Last year, we flew direct from Atlanta to Nice, France, and started our trip in nearby Antibes. This year, I have recently been keeping an eye out for a good deal with 4+ seats to anywhere in Europe for May 24th – 26th, 2025. I saw some award seats open up through Virgin Atlantic for a nonstop Delta flight from Atlanta to Barcelona on May 25th and jumped on that! Let’s look at the numbers.

At the time of writing this, here is what this flight costs/awards require PER PERSON when you book through different alliance carriers. Remember, this is the exact same flight leaving at 6:45 p.m. in the main cabin. These are one-way prices for the cash ticket, which tend to be higher than a round-trip cash ticket. Isn’t it interesting to see that while Virgin Atlantic has the highest cash price, it also has the lowest points price?

- Delta Price: $1238

- Virgin Atlantic Price: $1392

- Air France Price: $1238

- Delta Points: 110,000 Skymiles + $6

- Virgin Atlantic Points: 30,000 + $6

- Air France Points 33,000 +$33

We are a family of four. So, do I want to spend $5000 on these flights or 120,000 points (plus $24)? Of course, I would rather use points. The award booking has a redemption value of over 4 cents per point. That is way better than the $1200 they would be worth redeeming them at 1 cent each. But it gets better, because there was a transfer bonus!

Credit Card Transfer Bonuses

I haven’t told you about credit card transfer bonuses yet! When I bought these tickets last month, American Express Membership Rewards had a whopping 40% transfer bonus to Virgin Atlantic. So, I only had to transfer 88,000 American Express Membership Rewards to get the 120,000 Virgin Atlantic Miles. My redemption value is now almost 6 cents per point. It sure beats redeeming those 88k Amex Membership Rewards points for a $880 gift card, right? I got almost $5000 worth of airfare from the same number of points.

This is a great example of how transferable points are worth so much more. In this same scenario, if I had only used Delta credit cards for my day-to-day purchases and earned only Delta Skymiles, it would have cost me 440,000 Delta Skymiles, or 374,000 after my 15% cardholder discount for the same flight.

NOTE: All of the main credit card points transfer to Virgin Atlantic. So, I could have used my Chase Ultimate Rewards or Capital One Miles for this purchase. However, they didn’t have this bonus in December. When you go to the Transfer Points section of your credit card app or website, it will list any current transfer bonuses—most last about a month.

The key here in this example is that I TRANSFERRED my points from my credit card to the airline. Even if I had redeemed these American Express Membership Rewards through the American Express Travel Portal, it would have required 477,200 points! That’s over five times the number of points. Crazy, right?

How To Find Airline Award Flights

So, how do you know what airlines to check and where the sweet spots are?

Well, to be honest, it’s a lot of research, time, and personal experience. You can also use a variety of tools to help you find award flights. My favorites are PointsYeah and Roame Travel. This is a more in-depth topic that I will dig into in future posts. But keep in mind that there is no “quick and easy” way to do this. You have to put in the time, do your research, and run a lot of searches. I would hop onto those sites after you read this and just play around with award flight searches!

Also, sites like Thrifty Traveler Premium often send alerts for points deals and cash fares. I have the paid version, and it’s a game-changer! It even includes my local airport in Dothan, Alabama, whereas most flight deal alert services don’t.

NOTE: Miles and points are not always the best deals. If the cash price is a better value, I often book that and save my points. Calculate the redemption value to help you decide. For example, when booking hotels, we almost always use Airbnb or Booking.com in Europe because it’s often much more affordable than two hotel rooms on points, even if we find award availability.

Best Credit Cards For Points And Miles Beginners

I recommend three main cards for anyone getting started in the Points & Miles world! These are my personal favorites, and I keep them in my wallet. The links below are my referral links.

Of course, factor in which airlines you have access to at your nearest airport, and ensure you can transfer your points to them or a partner.

Capital One Venture X

In my opinion, the Capital One Venture X is the best starter travel credit card for many reasons. First, the annual fee can be easily offset with the $300 Capital One Travel Credit and 10,000 yearly bonus.

Second, it earns 2x on all purchases, making it a great everyday card for anyone who doesn’t want to overthink this process. Capital One Venture Rewards transfers to many of the airline loyalty programs I like to fly with.

This card is notoriously harder to get approved for. So, many people like to apply for it early on in their miles and points journey when they have fewer inquiries on their credit reports and fewer new lines of credit.

Click here to learn more about Capital One Venture X!

Chase Sapphire Preferred (or Reserve)

You need to hold one of these Chase Sapphire Cards to accumulate Chase Ultimate Rewards. Once you have them, you can convert some rewards earned with other cards, such as the Chase Freedom, to Chase Ultimate Rewards.

I like the Chase Sapphire Preferred card, especially if you already have or plan to get one of the other two cards I’m recommending in this post. The $95 annual fee is low, and you get a $50 Chase Travel hotel credit. I also like that it earns 3x on dining and 2x on travel purchases.

The Chase Sapphire Reserve’s annual fee was recently increased in mid-2025 to $795. This card is great if you are looking for a more robust card with lounge access, TSA PreCheck, and more. It’s $300 annual Chase travel credit that helps offset the annual fee, as well as a few other credits such as StubHub, AppleTV, etc..

You can not hold both of these cards at the same time, so pick one or the other. I like the Preferred because if you plan to get into this hobby, most of the lounge access, TSA credits, and other travel perks are already included in the other premium cards.

Click here to learn more about the Chase Sapphire Cards!

Click here to learn more about Chase Ink Business Cards!

American Express Platinum Card

I already went over the American Express Platinum Card’s $895 annual fee and credits to (more than) offset it above. This card is very popular in the miles and points world. It has really great travel perks, such as lounge access, automatic Hilton and Marriott Gold status, Hertz President’s Circle, and more. However, it’s not the best everyday earner. I pretty much only use mine to book airfare for the 5x points and travel protection. So, you also want to have one of the others for everyday spending.

Click here to learn more about the American Express Platinum Card!

Business Credit Cards

If you have a business, even a small one, you may want to apply for business credit cards. These often allow you to expand your number of accounts and take advantage of more sign-up offers. Plus, they can have great spend multipliers. For example, my American Express Business Gold Card earns 4X on my top 2 categories, including meta advertising and dining, which really allows me to rack up points!

The Chase Ink Business Cards are great starter business credit cards because they have low or no annual fees and great sign-up bonuses. The Ink Cash and Ink Unlimited have no annual fee, and the Ink Business Preferred has a $95 fee. And you can access Chase Ultimate Rewards with the Ink Preferred, even if you don’t have the Chase Sapphire cards listed above. For the other two, you need one of the Sapphire or Preferred cards to access Chase Ultimate Rewards points. And business credit cards don’t count toward your 5/24.

Chase 5/24 Rule

This is the only travel hacking “rule” that I want to point out in this post. Of course, you want to watch your velocity and not sign up for too many cards too soon. However, the Chase 5/24 rule may influence your decisions moving forward.

Chase will not issue you a new credit card if you have opened 5 or more accounts (with any bank) in the last 24 months. Business cards usually don’t count toward this. However, you can’t get approved for a Chase business card if you are over 5/24.

Will This Affect My Credit?

For so long, we have been taught that having credit cards is bad. However, that’s really only true if you are accumulating interest. I would even say that relying solely on debit cards is undesirable because you leave so much on the table. As long as you pay off all balances monthly, your credit score should not be affected. In fact, mine has increased by more than 40 points over the past few years and is now in the 800s.

However, opening multiple credit cards can temporarily affect your credit score. It’s important to monitor your credit regularly.

Cancelling Credit Cards

One last miles and points topic I want to address is canceling credit cards. You should never cancel a card in the first 12 months, but you may choose to do it after that if it isn’t serving you. Just be careful opening and closing too many credit cards.

I tend to keep most of mine rather than have a churn-and-burn mentality, because I can often offset annual fees with perks, such as annual free hotel nights on my Hyatt and IHG cards, or the annual companion certificates on my Delta Skymiles Business Platinum and Delta Skymiles Reserve cards.

Travel Hacking: Watch Me Travel On Points and Miles

That is a wrap on my beginner’s guide to points and miles! I hope that you learned a lot. I am so excited to be able to send this to several friends and readers that I have been promising it to!

As I mentioned above, I am going to London and Lisbon next week using miles and points. You can follow along at @ourlittlelifestyle on Instagram as I show you exactly how I booked this trip with miles and points, including six free hotel nights! Once I am done, I will save that in a story highlight and link it here.

Enjoy The Miles and Points Journey

I bet this was a lot to digest! But I wanted to take the time to really explain how travel hacking works. I wanted a guide that I could send to my friends and family, who are always asking how we can travel the world with our kids. Also, remember what I asked you to do at the beginning of this post; go back to the top and read it again! Now that you have read through it once, it will be easier to grasp some of the earlier concepts.

Believe it or not, there is a lot more to travel hacking beyond what I have shared here in this post. I am excited to add more travel-hacking content to my travel blog. Stay tuned, and make sure to subscribe to my newsletter for more tips, or follow us on Instagram for real-time deals and inspiration!

Honestly, using credit card miles and points and miles has changed my life. It is one of the easiest ways to travel more and spend less. Of course, there is no such thing as free travel. But by choosing the right cards, earning strategically, and redeeming points for maximum value, you can book incredible travel experiences around the world. Read all about our trips here, including my top travel tips. Happy travels!

Click here to read all of my Points & Miles content. As I write new posts on travel hacking and share more miles-and-points tips, they will appear there.

PIN My Travel Hacking Miles And Points Guide

Excellent guide. Thank you so much. Our family is about to embark on our travel hacking journey and this guide was very timely. We were considering getting one of the Alaska Air Atmos cards but now we have a framework to make an informed decision on whether that is the best path!