We may earn money or products from the companies mentioned in this post. As an Amazon Associate, I earn from qualifying purchases.

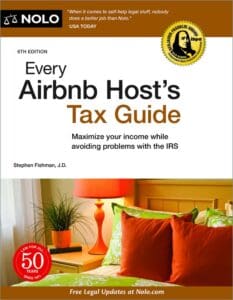

As an Airbnb host, you’re no stranger to the rewards and challenges of hosting guests from around the world. I own four vacation rentals and love the extra income that they provide my family with. However, while meeting new people and earning extra income are undoubtedly appealing, you must also know your tax obligations to ensure a smooth hosting experience. This blog post will explore the intricacies of Airbnb taxes, including insights from the book “Every Airbnb Host’s Tax Guide” by Stephen Fishman, J.D.

Whether you do your own taxes or hire someone to do it, every single Airbnb host should own this book. The 2025 version of this Airbnb tax guide came out in January 2025 and is the most up-to-date version. This is the one linked in this post, and the one you want to pick up to do your taxes here in early 2026! I will talk more in-depth about it later on in this post after discussing the 3 types of taxes you need to pay when owning and operating an Airbnb in most states.

If you are new here, welcome! I’m Sarah, and I am a top-rated Airbnb superhost. We own four condos on 30A, a popular coastal community in the Florida Panhandle.

I dedicate a portion of my blog to our Airbnb Hosting tips and experiences, as well as sharing our favorite family travel destinations!

If you are new to Airbnb hosting, you can visit my 5-Star Airbnb Hosting Guide for all of my resources in order!

However, if you are just thinking about becoming an Airbnb host and learning as much as you can, make sure to read 8 Truths I Wish I Knew Before Becoming An Airbnb Host.

Everything You Need to Know About Airbnb Taxes

Understanding your tax responsibilities is vital to running a legitimate and successful Airbnb business. But it’s complicated! So, let’s dig in!

There are three main types of taxes that we will discuss in this blog post. And, as an Airbnb owner, you are responsible for all three.

3 Types of Taxes for Your Airbnb Business

- State and Local Sales Taxes

- Property Taxes

- Income Taxes

1. State and Local Airbnb Taxes

In general, guests of your Airbnb property are subject to at least two different occupancy taxes. Typically, this includes state, county, and possibly additional local taxes.

As a host, you are responsible for ensuring your guests pay these sales taxes and for ensuring they are remitted to the proper parties.

For example, my four Airbnbs are in Walton County, Florida (near 30A), and are subject to two taxes totaling 12%. These taxes also apply to the cleaning fee and additional fees. Read more about how your cleaning fee is taxed in this post: How To Choose Your Airbnb Cleaning Fee.

The first one, the Florida state tax, is automatically added to my guest’s total, collected by Airbnb, and remitted to the state on my behalf. Easy peasy.

The second one, Walton County’s Tourist Tax, is not. Therefore, I must set up my Listing to manually collect this from my guests. Once I do that, it is sent through as a pass-through payment at the same time as my regular payout. To do this, go into your Listing –> Policies and Rules –> Taxes –> Add a Tax

Additionally, I have an account through the Walton County Tax Portal. Each month, I must personally go in and enter my nights sold and payments collected and then remit the 5% tax. Luckily, I collected it through Airbnb, and the money is in my bank account. This is a step that many new hosts miss!

This process varies quite a bit, state by state and county by county. For some countries, Airbnb collects and remits this. You need to determine this for yourself based on where you are located. Typically, you must also have your short-term rental registered with the county and state. Some additional licenses may be required.

2. Property Taxes On Your Airbnb Property

Beyond collecting sales taxes on rentals, you are responsible for paying property taxes on your land and structure. In many cases, this is wrapped up in your mortgage, and the bank takes care of the escrow and remission of these taxes.

However, if you own your property outright, you must do this yourself. You must ensure your taxpayer information is current with your local county tax assessor’s office. It’s easy for the mailing address to default to the property address, and you may not always receive mail there.

Often, you will find out that using your property as a short-term rental and not occupying it yourself limits your ability for exemptions, including homestead exemptions.

3. Airbnb Income Taxes

One of the most critical aspects of Airbnb hosting is understanding how the income you earn from hosting guests affects your income tax liability and tax return. I can’t possibly hit on every facet of Airbnb income taxes here in this post. There are so many variables, deductions, liabilities, and so forth. Furthermore, the structure of your rental business is critical when it comes to tax reporting and tax collection. Sole Props and Single Member LLCs will generally use Schedule E tax documents.

For more advanced business structures and entities, other rules that differ from what you read in this post and the following book may apply. In most instances, the owner will likely have retained tax professionals to help guide them through the process. They generally will gather all the necessary tax information for your rental property and ensure you file correctly each tax year.

Every Airbnb Host’s Tax Guide” by Stephen Fishman, J.D

This blog post aims to give you a light overview of the things to consider and then HIGHLY recommend that you purchase “Every Airbnb Host’s Tax Guide” by Stephen Fishman.

The new 2025 version is currently available, and year after year, this incredible Airbnb Tax resource earns 5-star reviews from hosts like us! I can personally tell you that I use this book very often. I have also owned the two previous versions over the years. Chances are that you are reading this in 2025; this is the most up-to-date version and the copy you will want to purchase now.

Regarding income taxes, “Every Airbnb Host’s Tax Guide” stresses that all income generated from your Airbnb rentals is taxable, including cleaning fees, security deposits, and any other payments from your guests.

Therefore, keeping meticulous records of your earnings is crucial to avoid potential issues with the IRS and your state. You also need to keep track of your expenses in real-time, monthly. Don’t wait until tax time and find yourself scrambling to account for your costs. Two key components are tracking your deductions and properly filing your taxes.

Income Tax Deductible Airbnb Expenses

To minimize your tax liability, you’ll want to take advantage of all the deductions available to you as an Airbnb host. Stephen Fishman’s book provides a comprehensive list of deductible expenses, including:

Operating Expenses: This can include everything from the coffee maker you purchased to your electric bill. When you are getting started, this will be a large initial expense and, therefore deduction during your first year.

Home office expenses: If you use part of your home exclusively for hosting guests, you may be eligible to deduct related expenses such as utilities, insurance, and mortgage interest.

Maintenance and repairs: Costs associated with maintaining your property, such as plumbing repairs, repainting, or fixing appliances, can be deducted.

Cleaning: Expenses for cleaning supplies, professional cleaning services, and general maintenance can also reduce your taxable income.

Property management fees: Any fees you pay to third-party property management companies or Airbnb for their services are deductible. This includes the Airbnb service fees that you pay on your Airbnb account.

Depreciation: You can depreciate your property’s value over time, which can significantly lower your tax bill.

Filing Your Airbnb Taxes

Typically, if you are running your short-term rental as a sole proprietorship like we do, you will account for your short-term rental investment properties by using a Schedule E. Fishman’s book walks you through the process of filing your Airbnb taxes, covering essential topics such as:

Reporting income: Understanding which tax forms to use and how to report your Airbnb income accurately.

Paying estimated taxes: As an independent contractor, you may need to make quarterly estimated tax payments to cover your tax liability throughout the year. You may even get a tax refund, staying on top of it this way. It’s much better than a huge tax bill and an extra fee for not prepaying.

Tax deductions: To minimize your tax burden, you must search for and claim all eligible deductions.

Recordkeeping: Keeping thorough records of your hosting activities, transaction history, and financial transactions to support your tax filings.

Pass-Through Deductions, QBI Qualified Business Income, and More

These topics were more complicated for us to grasp when we were getting started. Furthermore, when working through our taxes on HR Block’s online portal, we found ourselves repeatedly questioning ourselves. Every time, we returned to Fishman’s Airbnb taxes book and found the answer. I especially appreciate the photos of the actual tax forms included. His explanations are in-depth yet easy to understand.

I suggest that you do the same. I actually read the book cover to cover and found it very interesting!

Being Prepared For Airbnb Taxes in 2026 And Beyond

Being an Airbnb superhost comes with its own set of responsibilities, including understanding and managing your tax obligations.

Once you understand the three types of taxes, you can better anticipate and prepare for your tax liabilities. Owning and operating an Airbnb is a legitimate business and must be treated as such. Cutting corners and operating your vacation rental illegally can put you at risk on a local, state, and federal level with the Internal Revenue Service.

“Every Airbnb Host’s Tax Guide” by Stephen Fishman, J.D. (2025) is an invaluable resource to help you navigate the intricate world of Airbnb Income taxes. By staying informed and following the guidance in this book, you can ensure that your hosting venture remains profitable and compliant with tax laws. The topic is so complex that it takes him close to 200 pages to convey all of the necessary information. Something that simply can’t be done in a single blog post.

So, keep hosting those happy travelers and enjoy the financial benefits, knowing you’re on solid ground regarding Airbnb taxes. Also, if you are looking for more 2025 Airbnb resources, check out my blog’s Airbnb Hosting section!

PIN This Airbnb Taxes 2025 Guide For Later

Pin this blog post for later! You’ll find it really handy come tax time next year!

My Most Popular Airbnb Hosting Posts